Safeguard Your Home and Loved Ones With Affordable Home Insurance Program

Relevance of Affordable Home Insurance

Protecting economical home insurance coverage is essential for safeguarding one's residential property and financial wellness. Home insurance policy offers protection versus numerous dangers such as fire, burglary, natural catastrophes, and personal liability. By having an extensive insurance coverage plan in place, property owners can relax assured that their most considerable investment is shielded in case of unforeseen scenarios.

Affordable home insurance policy not only supplies monetary safety and security yet also uses satisfaction (San Diego Home Insurance). In the face of rising home values and construction expenses, having an economical insurance policy ensures that property owners can conveniently rebuild or repair their homes without encountering significant financial problems

In addition, affordable home insurance policy can likewise cover personal valuables within the home, offering compensation for products damaged or taken. This coverage prolongs past the physical structure of your home, protecting the contents that make a residence a home.

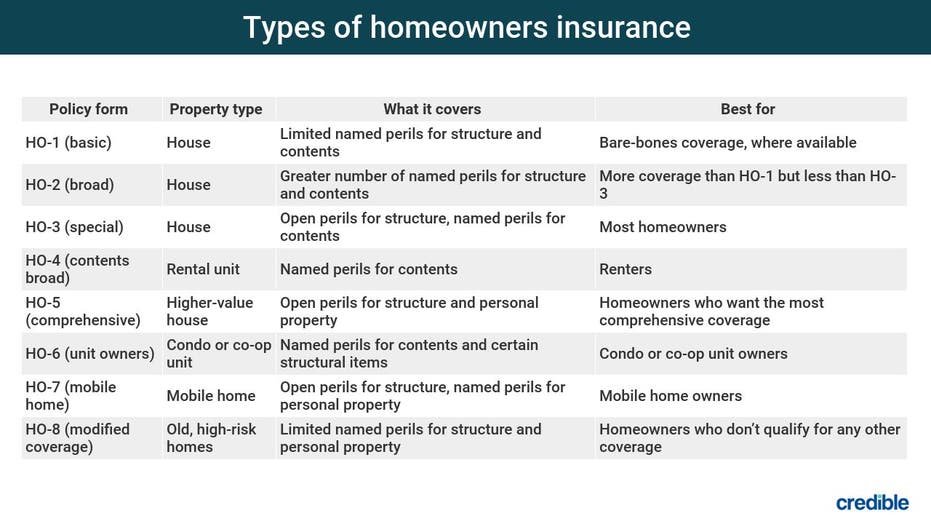

Insurance Coverage Options and Purviews

When it concerns insurance coverage restrictions, it's crucial to comprehend the optimum amount your plan will pay for every type of coverage. These limits can vary relying on the policy and insurance provider, so it's vital to evaluate them meticulously to guarantee you have appropriate defense for your home and properties. By understanding the protection alternatives and limits of your home insurance coverage plan, you can make informed choices to protect your home and liked ones properly.

Aspects Influencing Insurance Policy Costs

Numerous variables substantially affect the costs of home insurance plans. The location of your home plays an essential duty in establishing the insurance costs.

Moreover, the sort of insurance coverage you pick straight impacts the expense of your insurance coverage. Choosing additional protection choices such as flooding insurance coverage or quake insurance coverage will enhance your premium. Picking higher protection restrictions will result in greater prices. Your deductible amount can also impact your insurance coverage prices. A higher insurance deductible usually indicates lower premiums, yet you will need to pay more expense in the event of a case.

Additionally, your credit history, declares background, and the insurer you choose can all affect the cost of your home insurance plan. By considering these variables, you can make educated choices to aid manage your insurance costs successfully.

Comparing Carriers and quotes

Along with contrasting quotes, it is visit this website crucial to assess the online reputation my explanation and financial security of the insurance policy companies. Search for consumer reviews, rankings from independent companies, and any background of problems or regulative actions. A trustworthy insurance service provider need to have a great track record of immediately processing claims and giving exceptional client solution.

Furthermore, think about the specific insurance coverage functions offered by each supplier. Some insurance companies may provide additional advantages such as identity burglary defense, equipment malfunction coverage, or coverage for high-value items. By very carefully contrasting companies and quotes, you can make an informed decision and choose the home insurance coverage plan that ideal fulfills your demands.

Tips for Saving Money On Home Insurance Coverage

After extensively contrasting quotes and suppliers to locate one of the most appropriate protection for your requirements and budget plan, it is prudent to explore reliable techniques for conserving on home insurance. Among the most significant means to minimize home insurance coverage is by packing your plans. Numerous insurer use discount rates if you buy several plans from them, such as combining your home linked here and vehicle insurance policy. Raising your home's safety and security procedures can additionally cause financial savings. Installing security systems, smoke detectors, deadbolts, or a lawn sprinkler can reduce the threat of damages or burglary, possibly reducing your insurance coverage costs. Additionally, maintaining a good credit rating can positively influence your home insurance policy prices. Insurance companies frequently think about credit history when identifying premiums, so paying expenses in a timely manner and handling your credit rating sensibly can lead to reduced insurance prices. Consistently examining and upgrading your policy to show any kind of adjustments in your home or situations can guarantee you are not paying for protection you no longer requirement, aiding you save money on your home insurance policy costs.

Conclusion

In verdict, securing your home and loved ones with affordable home insurance policy is important. Executing suggestions for conserving on home insurance coverage can also help you protect the essential defense for your home without breaking the bank.

By unraveling the ins and outs of home insurance coverage plans and checking out functional techniques for securing affordable protection, you can guarantee that your home and enjoyed ones are well-protected.

Home insurance policy policies usually provide numerous insurance coverage options to shield your home and valuables - San Diego Home Insurance. By understanding the coverage choices and restrictions of your home insurance coverage policy, you can make informed choices to secure your home and loved ones effectively

Regularly examining and updating your policy to mirror any kind of modifications in your home or conditions can ensure you are not paying for coverage you no longer requirement, helping you conserve money on your home insurance premiums.

In verdict, securing your home and liked ones with economical home insurance policy is critical.